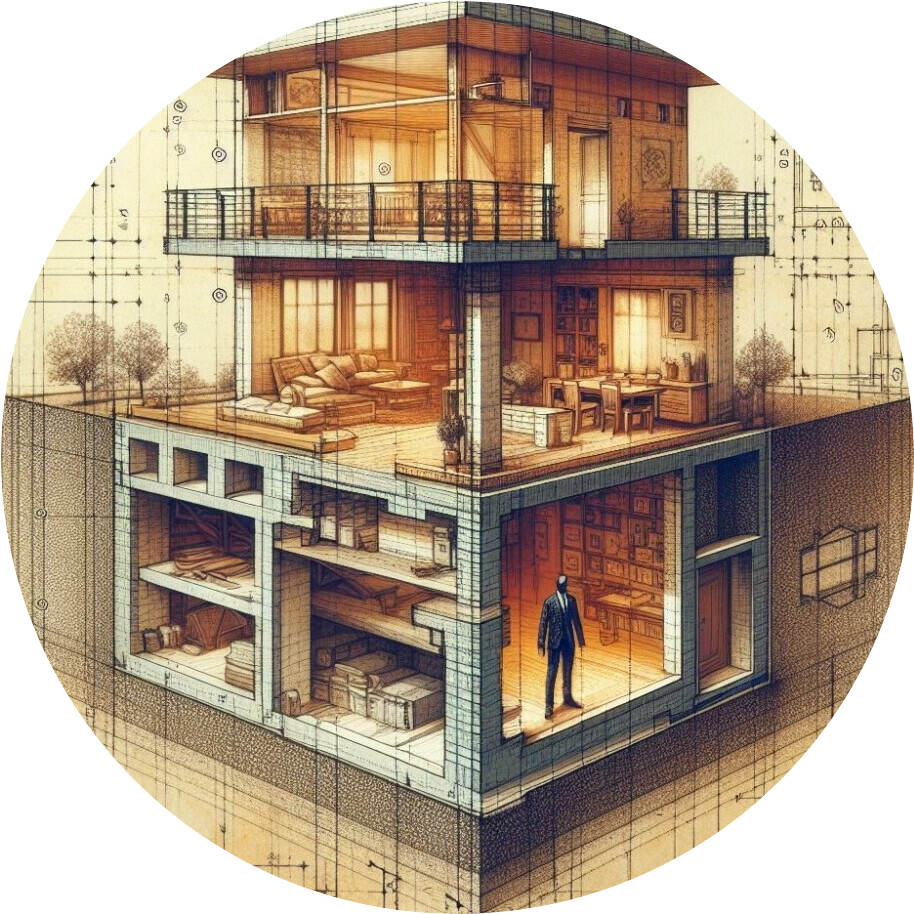

I believe that building wealth starts with mastering the essentials of financial literacy. It’s like building a house; you need a solid foundation before you can add the walls and roof. The first thing I recommend is getting a good handle on the basics of personal finance, which involves understanding how money works in your day-to-day life.

Creating a budget is crucial. It’s about knowing what comes in and what goes out. I encourage you to track your income and your expenses. This simple task can reveal so much about your spending habits and help you figure out where you can cut back. It’s a basic rule of wealth building to spend less than you earn, and for good reason. This habit alone can set you on the path to financial success.

Next, could you take a hard look at your expenses? Some will be non-negotiable, but others may surprise you. How much are you spending on eating out, subscription services, or even that daily coffee? Small changes can add up to significant savings over time.

Setting financial goals is an important step. Whether it’s saving for a vacation, paying off debt, or buying a home, having clear, specific, and achievable goals gives you something to work toward. When it comes to planning for the unexpected, an emergency fund can be your financial lifesaver, helping you avoid debt when life throws you curveballs.

It’s also time to get acquainted with investing. You don’t need to become an expert overnight, but understanding the difference between stocks, bonds, and mutual funds is a good place to start. These are the tools you’ll use to build your financial future, and knowing how they work can make a difference in your approach to wealth building.

As a bridge to the next section, it’s key to remember that growing your wealth is not just about what you save, but also about how you make your savings grow. That’s where smart investing strategies come into play, which is what I’ll talk about next.

Strategies for Growing Your Wealth

Now that you’ve grasped the essential financial literacy concepts and laid a solid foundation, it’s time to explore how to grow your wealth effectively. One of the most powerful principles in finance is the effect of compounding interest. This is where your earnings generate more earnings over time, exponentially increasing your wealth. To harness this power, start investing early and consistently, even if it’s small amounts.

Diversification is your ally in the investment world. By spreading your investments across various asset classes, such as stocks, bonds, and mutual funds, you reduce the risk of a major loss from a single poor-performing investment. For beginners, mutual funds can be an excellent starting point as they offer built-in diversification and are managed by professionals.

Don’t overlook retirement accounts; they are critical. Individual Retirement Accounts (IRAs) and 401(k)s are designed to optimize long-term savings with tax advantages. Depending on your country, similar vehicles exist and understanding them is key to maximizing your wealth growth potential.

Real estate investing can also fortify your financial portfolio. Whether it’s purchasing a rental property or investing in a real estate investment trust (REIT), real estate offers a tangible asset that has historically appreciated over time. Be mindful, though, that real estate requires significant research and understanding of the market.

Staying educated can’t be understated. Keep your financial knowledge current by reading books, attending seminars, or even following reputable financial news sources. A well-informed investor is a savvy investor.

Lastly, I would like to remind you that seeking professional advice is not a weakness but a strategic move. Financial advisors can provide personalized advice tailored to your unique financial situation and long-term goals. Investing in sound advice can save you from costly mistakes and help you navigate the complexities of wealth accumulation.