So you’re wondering how to start building wealth, especially if you don’t have a lot of money to begin with? I’m going to lay it out for you. Building wealth isn’t reserved for the already rich; it’s achievable for everybody, including those starting from a place of financial disadvantage.

So you’re wondering how to start building wealth, especially if you don’t have a lot of money to begin with? I’m going to lay it out for you. Building wealth isn’t reserved for the already rich; it’s achievable for everybody, including those starting from a place of financial disadvantage.

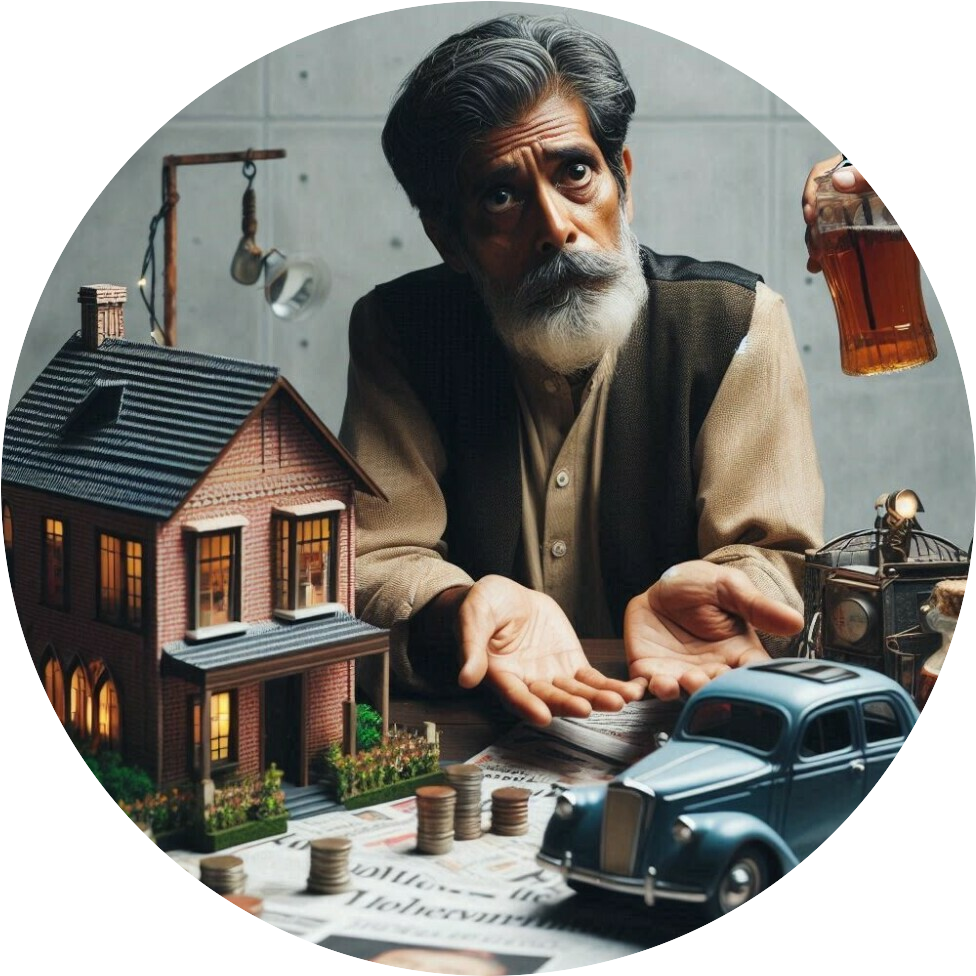

Wealth building is all about accumulating assets that will increase in value or generate income over time, thus providing you with financial stability and security. The importance of this cannot be overstressed. It’s not just about having cash at hand; it’s about creating a cushion that allows you to handle life’s ups and downs without financial stress.

Now, I’m not glossing over the fact that if you’re financially disadvantaged, you face real hurdles. High-interest debt, scarce resources, and limited access to financial education are all barriers in the way of wealth creation. But that’s not the whole story.

There are plenty of myths that suggest wealth building is out of reach for the poor. I’m here to help you navigate past those myths. You might think, for example, that you need a lot of money to start saving or investing. In my opinion, and backed by many personal finance experts, this isn’t the case. With the right strategies, you can begin with what you have, however small that may be.

I’m going to introduce you to foundational strategies that are crucial for anyone’s financial growth but are particularly valuable for people with limited fiscal resources. The first of these strategies? Budging. Yes, budgeting can be tough, and it’s a bit of a buzzword these days, but it’s absolutely vital if your goal is to build wealth.

You’re going to find out about how to transform budgeting from a chore into an effective wealth-building tool. It’s not just about tracking every penny – although that’s part of it – it’s about understanding where your money goes and making intelligent choices accordingly.

Don’t worry too much about getting everything perfect right off the bat. Wealth building is a marathon, not a sprint. You can always adjust your approach as you learn and grow financially. The fact you’re reading this shows you’re willing to take that first step. Let’s prepare to budget strategically to pave your pathway to wealth.

Budgeting Basics: Harnessing Financial Discipline

In my opinion, the cornerstone of turning financial tides in your favor is mastering the art of budgeting. You’re going to find out about the practical steps to creating a budget, geared particularly towards individuals managing with limited funds.

So, what’s budgeting? Don’t worry too much about complex finance jargon; it’s simply a plan for how to spend your money. If you want to control your financial outcomes, this is the driver’s seat. Choose something that resonates with you—whether it’s a detailed spreadsheet, a simple app, or pen and paper.

Despite what you might think, creating a workable budget doesn’t require an accounting degree. It’s about understanding your income, your necessary expenses, and how to manage the remainder. A lot is happening very quickly when you’re trying to make ends meet, but with a well-structured budget, you’ll find pockets of opportunity where savings can grow.

You can always adjust your approach down the road. To get started on a budget, list out your incomes and expenses. Track everything for a month, look for patterns, and then see where you can cut back. This might mean prioritizing needs over wants, at least initially.

I’ve seen many examples of individuals who felt powerless against their financial situation until they took this step. By reducing expenses — such as opting for a less expensive phone plan, cooking meals at home instead of dining out, or using public transportation — they discovered extra money to set aside each month.

Your first attempt at budgeting doesn’t need to be your last. Expect to revise your budget frequently as your financial situation and goals change. And remember, the goal here isn’t perfection; it’s progress. Each dollar you save is a brick in your wealth-building fortress.

As we shift gears into the next section, investing wisely with limited resources, bear in mind that the modest savings from your budgeting can be the seed money for your investment efforts. That’s how wealth starts to take root, and I’m here to help you understand how that can happen even when funds are low.

Investing Wisely with Limited Resources

If you’re thinking that investing is only for the wealthy, think again. Investing is a critical tool for building wealth, even if you’re starting with small amounts.

The main advantage of investing, as opposed to just saving, is the power of compounding returns. Compounding can turn your small investments into a much larger sum over time.

You might be wary about investing if you have a limited budget, but there are low-risk investment options that can serve as a good starting point. For instance, high-yield savings accounts, certificates of deposit (CDs), and Treasury securities offer more security for your earnings.

For those who can handle a bit more risk, index funds and ETFs (Exchange-Traded Funds) are a great way to tap into the stock market without needing to pick individual stocks. These funds track the performance of an index, such as the S&P 500, and provide diversification, which is key to managing investment risk.

Even contributing small amounts to a retirement account like a Roth IRA can make a big difference. If your employer offers a retirement plan with matching contributions, that’s even better—take full advantage of that free money.

However, it’s not just about choosing the right investments. Financial literacy is essential, so you understand what you’re investing in and why. Many communities offer free or low-cost workshops and courses to help you educate yourself on financial matters.

Remember, the earlier you start investing, the more you can benefit from compounding returns. Even if it’s just a few dollars a week, it’s better to start now than to wait until you think you can afford to invest.

Creating Additional Income Streams on a Tight Budget

Now what about multiplying your money-making channels? That’s going to include looking beyond your main job and exploring the vast arena of side gigs and passive income. I’m here to help you with some practical strategies to increase your earning potential, even when you’re starting from low ground.

Why are multiple income streams so pivotal for your financial growth? Well, they not only pad your wallet but also provide a safety net in case one source dries up. Choose something that resonates with you, perhaps a hobby that can be monetized or a skill that’s in demand.

Consider the digital marketplace, where opportunities abound for the entrepreneurially spirited. This could mean starting an online business with minimal startup costs, or selling products on various platforms. If you’ve got a gift for creativity, platforms like Etsy or Redbubble could be your golden ticket.

Don’t worry too much about raking in big bucks immediately. Success in creating additional income streams often comes from consistency and the gradual build-up of your side business. You can always adjust your approach down the road, refining your strategies as you learn what works best for you.

In my opinion, it’s crucial to balance the demands of your primary income source with the effort you put into additional streams. Remember, your first attempt doesn’t need to be your last—experiment, learn, and persist. Over time, even small earnings from multiple sources can significantly bolster your wealth-building journey.