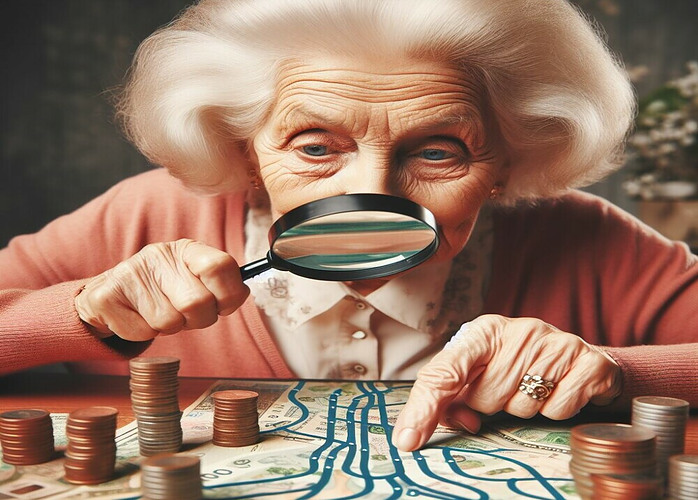

I’m going to walk you through the significance of maintaining a smart budget during your golden years. You’re going to find out about the essentials of marrying income to expenses in a way that prioritizes your financial health. Just remember, somewhere along this continuum is a break-even point. if you can’t marry your income/expense budget, you must also look into generating extra income.

Let’s start with the basics: tracking your cash flow. In my opinion, knowing exactly where your money is going is half the battle won. This isn’t merely about monitoring bank balances, it’s also about understanding your spending patterns.

If you’re not tech-savvy, don’t worry too much. There are budgeting tools and apps specifically tailored to seniors. You can always ask for help from family members or friends to set these up. Once you’re comfortable, these resources can make budgeting nearly effortless.

Now, it’s crucial to discern wants from needs. This step will help you trim the fat, so to speak. Choose something that resonates with you when it comes to non-essentials and let go of the rest. It’s all about making calculated decisions that favour your wallet.

What does this shift towards conscious spending lead to? It transitions smoothly into finding ways to whittle down household expenses. Once you’ve nailed down budgeting, reducing these expenses is going to feel like the logical next step. I’ll guide you through that in the following section.

Reducing Household Expenses

Trimming your household expenses can leave your wallet feeling a bit heavier, and it’s easier to achieve than you might think. Let’s start by focusing on your utility bills. If you’re like most people, you probably don’t give them much thought beyond paying each month. However, small changes in habits can lead to big savings. Try using energy-efficient bulbs, consider a programmable thermostat, and remember to unplug devices when they’re not in use.

Moving on to another big-ticket item: groceries. Have you ever considered meal planning? It’s a game-changer. Planning your meals can help prevent impulse buys and reduce food waste. Choose generics over brand names when possible, and don’t forget to look out for senior discounts at your local stores. Some strategically planned shopping trips can help keep your bank balance healthy.

Now, let’s talk housing. It’s typically one of the largest monthly expenses. If you have extra rooms gathering dust, think about whether downsizing might work for you. Another option could be bringing in a roommate or two—after all, it’s not just for the young. Alternatively, explore what senior living communities offer as they often include many amenities for a single fee, potentially providing savings on entertainment and healthcare costs.

Transportation is another area where you can cut costs. Owning a car is convenient, but it’s also a money pit, considering insurance, maintenance, gas, and so on. Public transportation is not only easier on the budget but also on the environment. Plus, many transit systems offer reduced fares for seniors. Embracing these options can contribute to your financial health and give you a little extra to spend on fun activities—which, speaking of, is exactly where a minimalist lifestyle can bring you even more benefits.

Embracing a Minimalist Lifestyle

In my opinion, adopting a minimalist lifestyle can be much more than a method to save money; it’s a pathway to freedom and stress relief, especially in your golden years. You’re going to find out about how minimalism can improve your financial health and overall well-being.

Let’s start by considering the psychological perks. Trimming down belongings can help declutter your space as well as your mind, leading to a calmer and more serene environment. It’s about choosing simplicity and space over stuff, which can be incredibly liberating.

So how do you begin? Aim to declutter responsibly. Whether it’s selling items online, donating to local charities, or passing things down to family members, there are numerous ways to ensure your belongings continue to be useful while you benefit from a more organized space.

Next, think about the shift in mindset. Emphasizing experiences over possessions means spending on activities and adventures that enrich your life rather than on physical items. This isn’t just about saving money, it’s also about creating memories and lasting happiness.

Community engagement is another aspect of a minimalist lifestyle. Seniors can take advantage of a variety of social activities that are cost-effective or free. This includes volunteer work, community classes, or local clubs. Such involvement not only nurtures social connections but also promotes a sense of purpose and belonging.

In conclusion, embracing minimalism as a senior isn’t about making sacrifices. It’s an opportunity to reevaluate what’s truly important and make room for it. You might just find that, by having less, you’re paving the way for a richer and more rewarding retirement.

Generating Extra Income

As a last resort, after embracing minimalism as a senior and the income/expense budget is still not in equilibrium, you can use your years of experience and know-how to start an online business. There are lots of options. Especially in the field of affiliate marketing. Don’t be shy, give it a try.